This article will discuss:

#1 Open a Traditional IRA account

The first step is to open a traditional IRA account and not a Roth account directly. If you already have an account, jump to the next step.

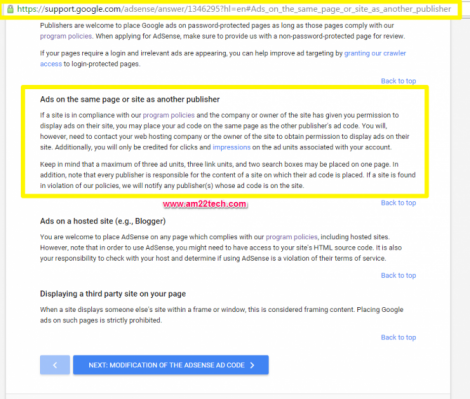

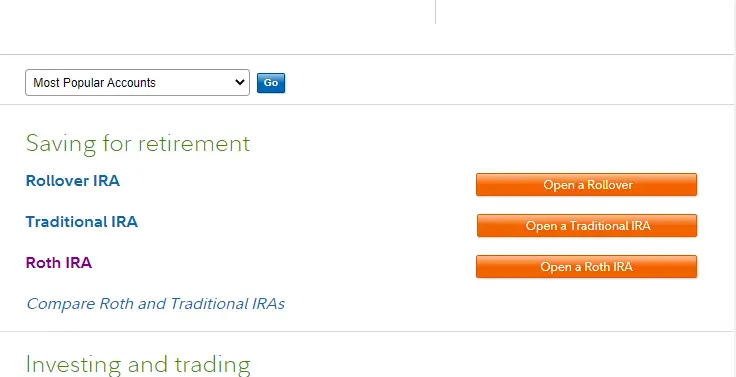

Visit the Fidelity.com website and click on ‘Open an Account’.

Fidelity offers $100 as promotional money if you use coupon code FIDELITY100.

Click on the ‘Open a Traditional IRA‘ button.

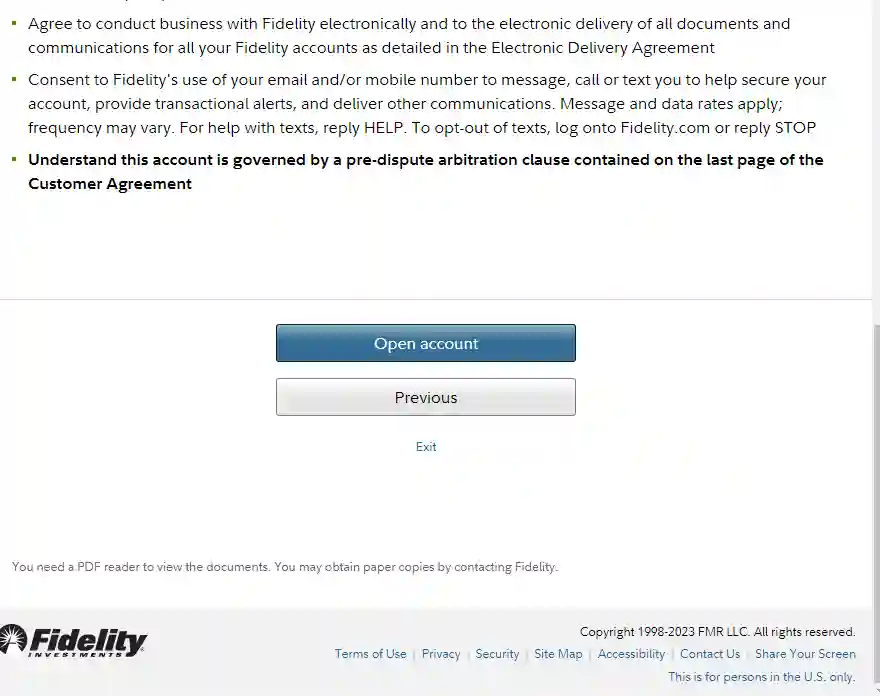

Read the terms and conditions and then click the ‘Open Account‘ button.

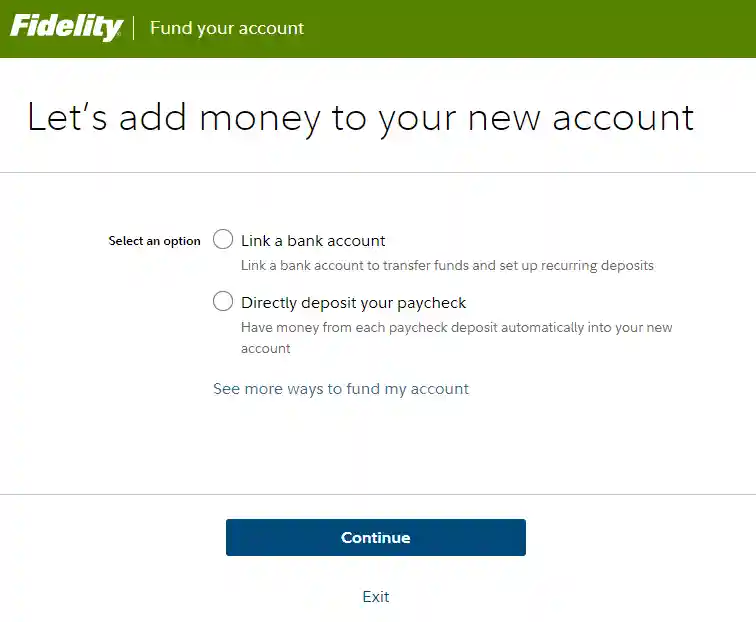

Once your account is open (which takes less than a minute online), you will be presented with the option to fund this account.

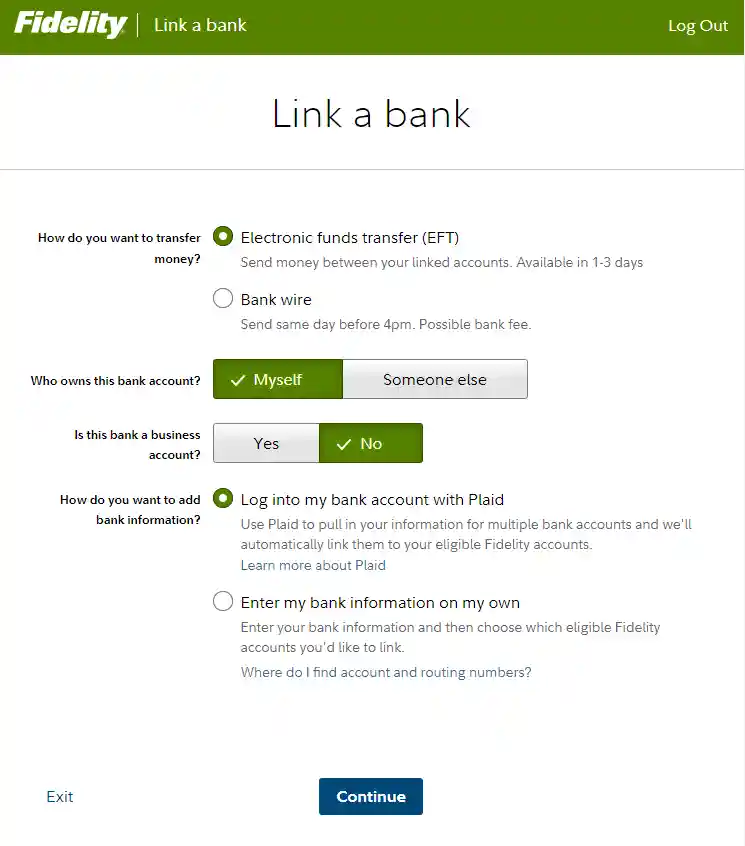

I suggest linking your bank account with this traditional IRA account to easily transfer money. I used the direct login method as shown below (using Plaid).

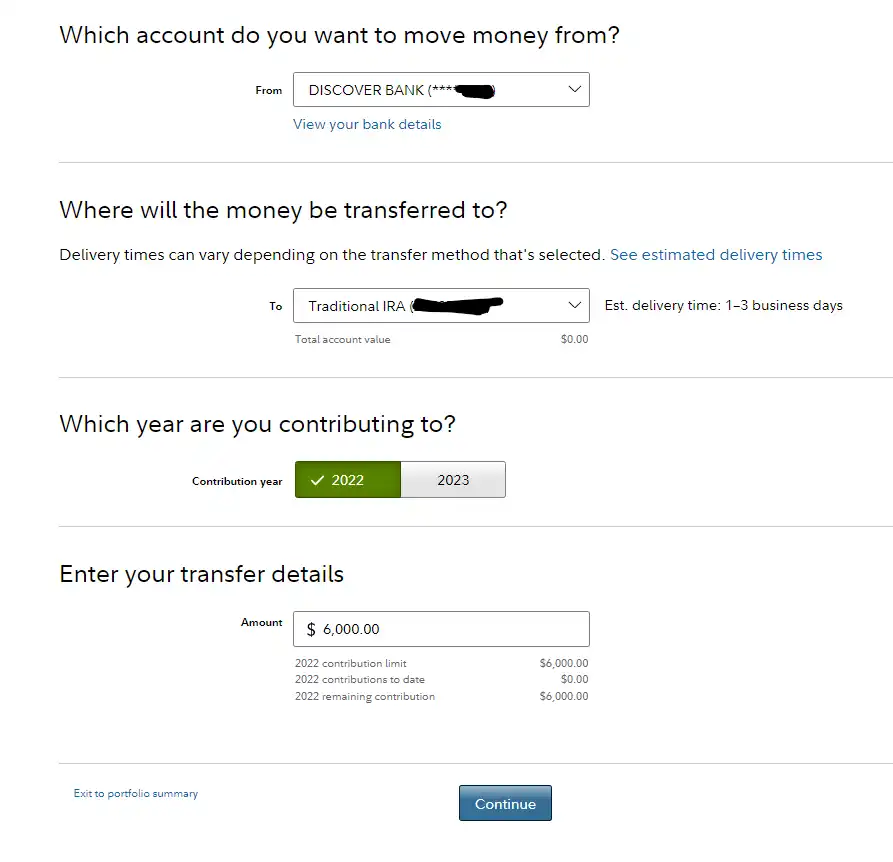

You can start the money transfer immediately after you have connected your bank account.

- Tax Year 2023 – $6,500 if you’re under age 50 / $7,500 if you’re age 50 or older.

- Tax Year 2024 – $7,000 if you’re under age 50 / $8,000 if you’re age 50 or older.

This limit changes every year.

AI Passport & Visa Photos in Minutes!

No studio, no waiting. Get perfectly compliant photos from your phone.

✨ Get My Photo Now See how our AI transforms your phone photo into an embassy-ready passport picture!

See how our AI transforms your phone photo into an embassy-ready passport picture!I suggest putting the maximum allowed amount to it to get the most benefit out of Roth IRA’s tax-free growth.

At this point, your traditional IRA account is open and has the money needed to move it to a Roth IRA.

Points to note:

- First-time traditional IRA account:

- If you have opened this account for the first time with Fidelity, it will take about 5-6 days to show this money as ‘available’ in your traditional account.

- The amount may keep showing as transferred from your bank to fidelity, but until it is marked as ‘available’, you cannot transfer it to a Roth IRA.

- Already have a traditional IRA account:

- The money may be transferred immediately or within 1 day and may show as ‘available’ the next day.

#2 Open a Roth IRA account

Our next step is to open a ROTH account.

Visit Fidelity’s open account page once again and click on the ‘Open Roth IRA’ account button.

Follow the next steps to open the account.

When you reach the ‘fund this account’ or transfer money to this account step, just close and do not do anything.

For backdoor Roth, we need to specifically move money from ‘bank account’ to ‘traditional IRA’ AND then to ‘Roth IRA’ and not directly from a bank account to ‘Roth IRA’.

Bank account -> Traditional IRA -> Roth IRA

#3 Transfer money from Tradition to Roth account

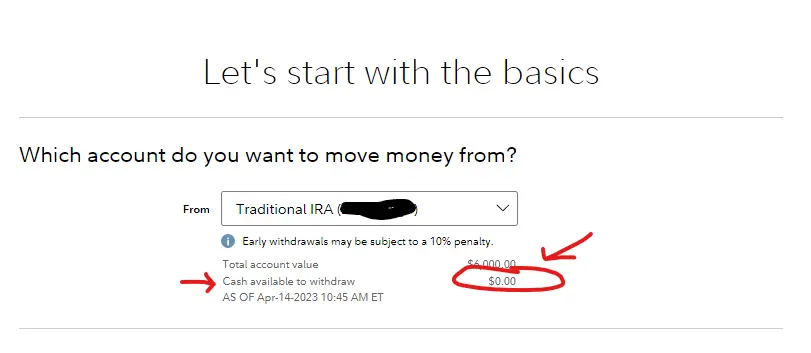

Now, wait for the money to show up as ‘Cash available to withdraw‘ in your traditional IRA account. If it shows zero, then you need to wait.

Once it is available, start the transfer process.

Click on the ‘Transfer Money’ button.

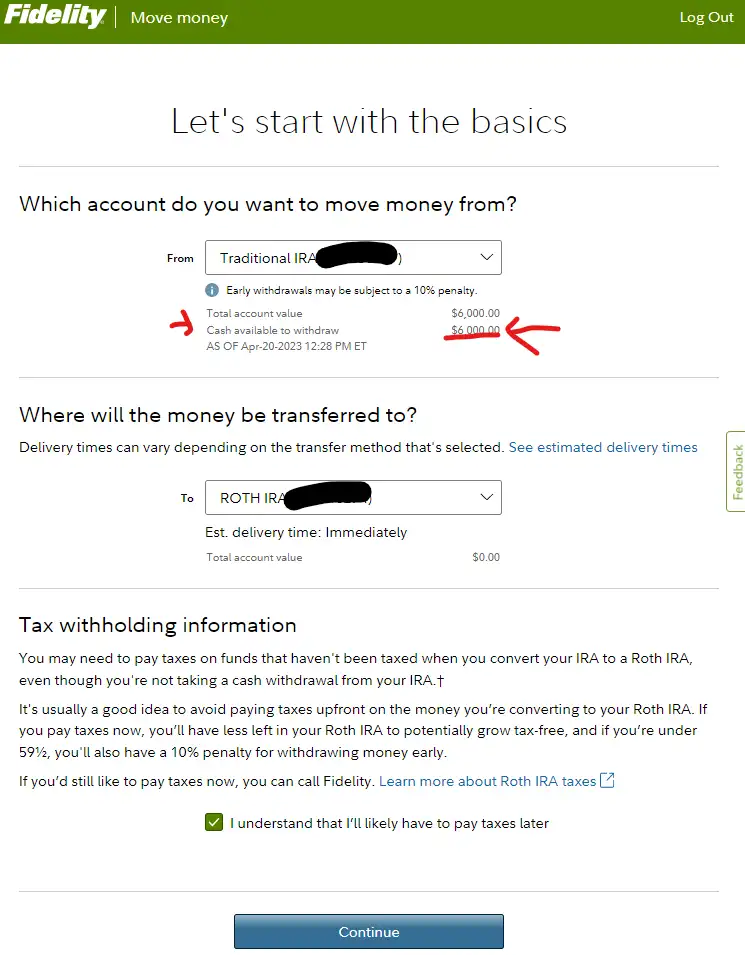

- Select the ‘Traditional IRA’ account as the first account.

- Select the ‘Roth IRA’ as the second account where the money needs to go.

Make sure that the amount shows as ‘available’.

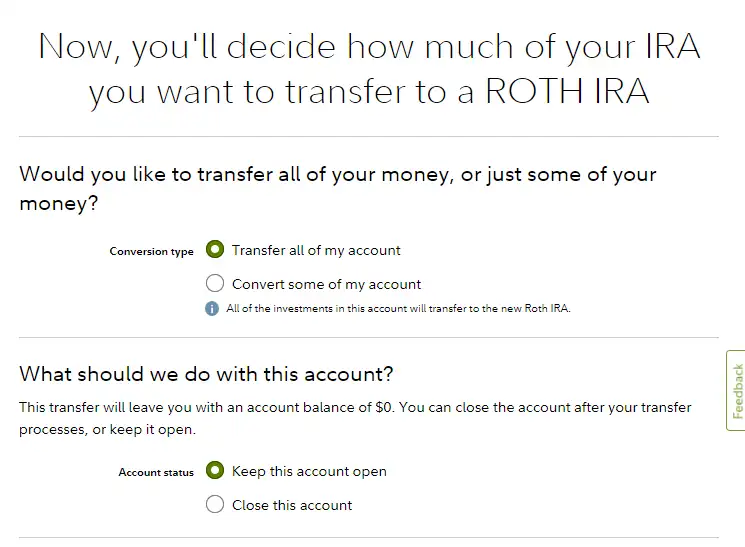

Click the ‘Continue’ button and you will be asked if you want to keep the ‘traditional account’ open or close it.

I suggest keeping the account open as you can use it next year for the same backdoor roth process again.

Professional Visa Filing Service

Your trusted partner for a smooth application process.

Expert Support & Preparation

Get hassle-free visa extension and EAD filing professional support. Includes preparation, printing, photo editing, mailing and RFE preparation.

Fast & Efficient Service

Applications filed within 1-2 days with all documents ready. Emergency filing is also available to meet urgent deadlines.

Passport Photo Assistance

We professionally edit your photos to meet all US visa requirements, including background removal and proper alignment. Photo printing is included.

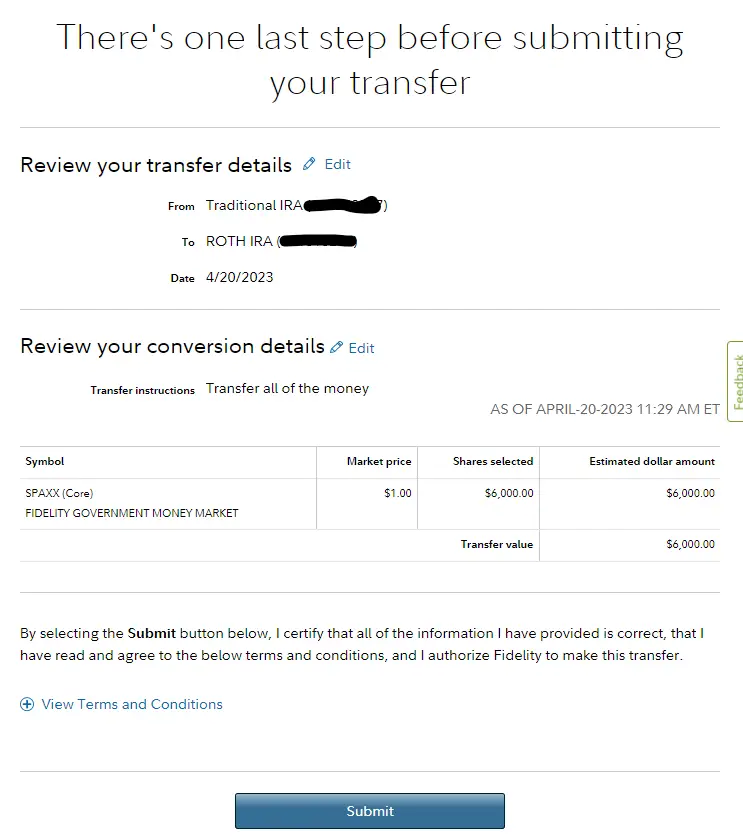

The last step is to review and submit the transfer.

Note that the amount is always shown as SPAXX (Core) Fidelity Government Money Market instead of cash. This is fine as this is treated as cash for transfers from one account to the other.

Once you have the money transferred, you can buy stocks using this Roth account.

FAQ

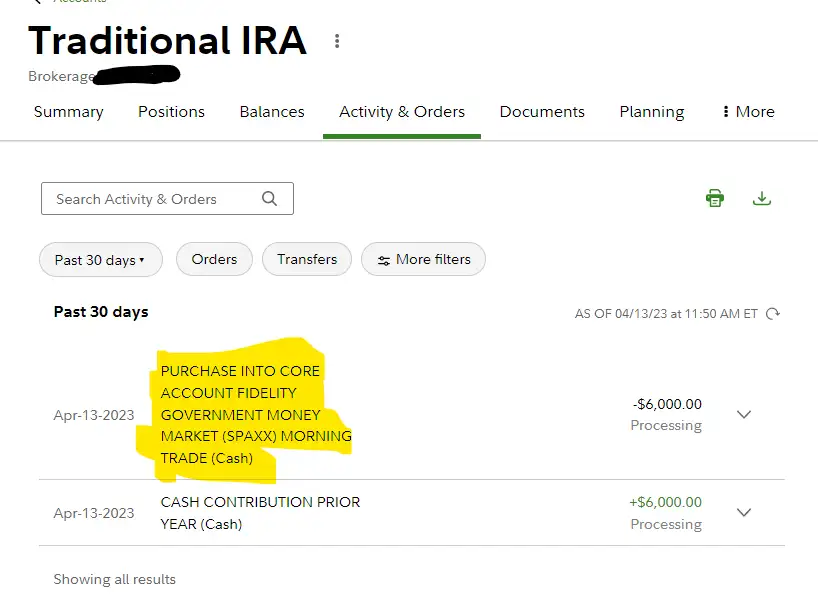

Fidelity calls its cash a ‘core position’. For a traditional IRA account, whenever you add any cash, it will automatically be moved to a SPAXX balance.

I got the panic too when I was trying to do a backdoor Roth IRA and saw that traditional IRA cash was moved to SPAXX automatically.

I did reach out to Fidelity customer care and they confirmed that we cannot stop or change the SPAXX in traditional IRA. The system automatically moves all cash to SPAXX.

The contribution to a traditional IRA can be made between 1 Jan to 15 April of next year. It does not matter if you file an extension for your tax return, the deadline is still 15 April.

Example: For the year 2023, the contribution to a traditional IRA can be done anytime between 1 Jan 2023 to 15 April 2024.

To move this money from a traditional to a Roth IRA account, you can do it anytime. I suggest moving the money from traditional to Roth anytime before 31 Dec.