ACS assessment is required for Australia PR using 189, 190 visa. ACS is Australia Computer Society and is the official agency for assessing the 2613 category job codes for permanent residency application.

ACS assesses your education to match your degrees with Australia’s educational system and provide a certificate to claim ICT major or Minor status including your work experience.

A positive ACS assessment is required to claim education, work and spouse points on Australia PR application.

This article will discuss:

ACS 2, 4 or 6 year Deduction

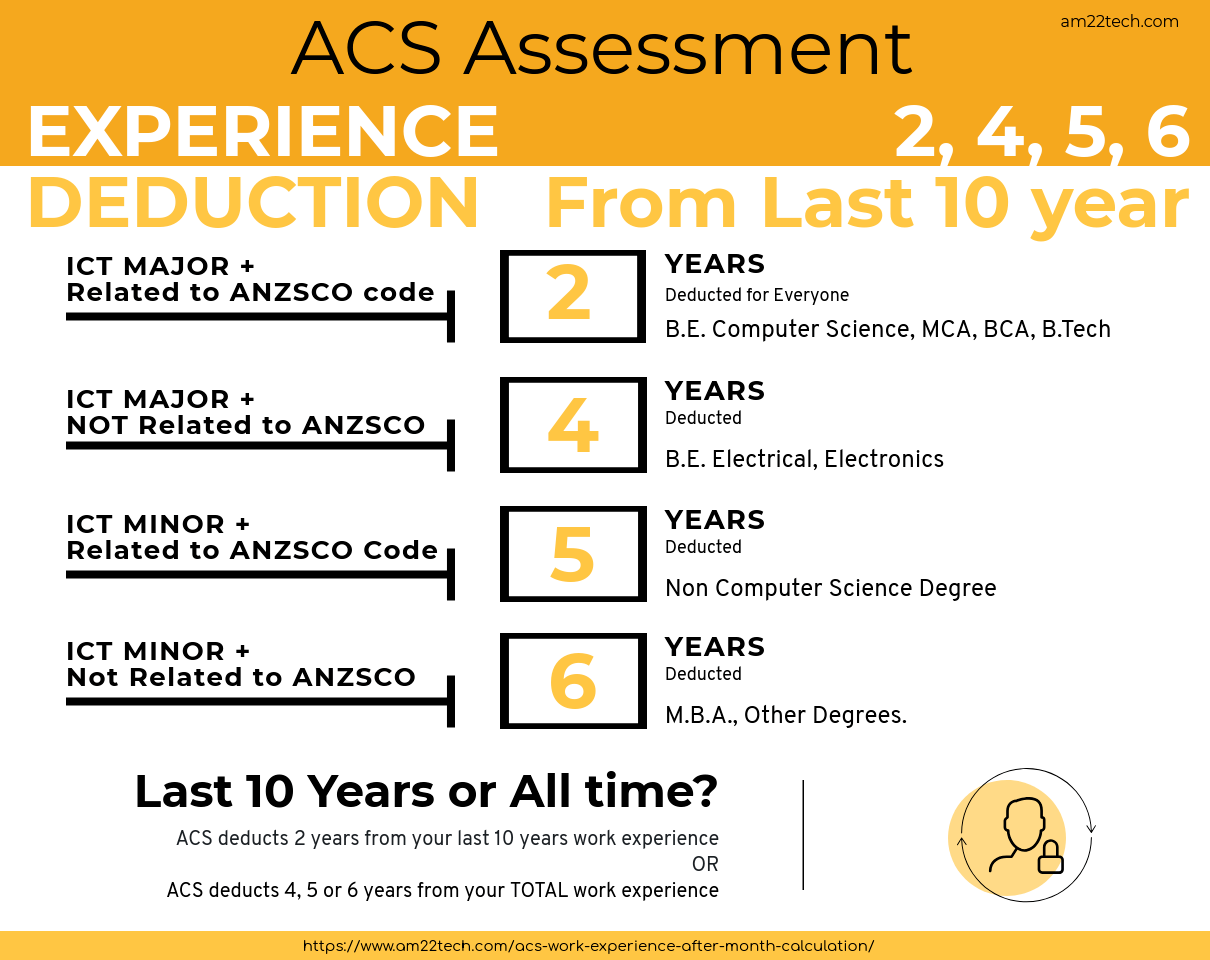

ACS deducts minimum 2 years and maximum 6 years from your total work experience. 2 years are reduced from all candidate’s work experience as ACS considers initial 2 years as training period.

The number of years that will be deducted depends on how closely your education matches with your job profile.

Example:

#1 B.E in computer science, ANZSCO code 261313

If you have done Bachelor or Engineering in Computer science and apply for ACS assessment with code 261313 as software engineer, you will see a deduction of 2 years.

The B.E. in computer science is considered ICT major because of its course subjects giving software training which matches with job code 261313.

#2 B.E. in Electrical and Electronics, ANZSCO code 261313

If you completed your education as Bachelor of Electrical and Electronics and are now working in I.T sector as software developer, you will see 4 years deduction from your total work experience.

The B.E. in Electronics is not considered an ICT major as it does not have the software training subjects a major.

ACS ‘AFTER’ Start Date

Your work experience is marked as relevant from a specific month and year in ACS report.

Check this sample ACS assessment report for an example:

The most important date is ‘AFTER month‘ that’s mentioned on the second line.

Since, they have only specified the month and not specific date, the biggest confusion is over what date to use in Australia SkillSelect EOI (Expression of Interest).

The official ACS guidance is that you can use the start DAY in EOI as the day of the date you filed your ACS application.

Example, in the sample ACS report, AFTER April 2010 is the start month for relevant work experience and this application was filed on 3 April 2018.

You can use the start DATE while filing EOI as 3rd April 2010.

Lot of forums and people might ask you to use the next month’s first day as start date due to the word ‘AFTER April 2010′. But, this is NOT true.

Not sure why ACS does not clearly write the full date in their letter to avoid any confusions. That’s how it is and we can’t change it.

Relevant Work Experience Calculation

- ACS deducts 2 years from your last 10 years work experience OR

- ACS deducts 4 years from your TOTAL work experience.

This deduction criteria is in addition to the one mentioned earlier based on education degree.

In sample report above, person has 11 years 6 months relevant work experience starting from June 2006.

Assuming degree is considered as ICT Major and relevant to your nominated occupation, these rules will apply:

ACS will deduct 2 years from last 10 years or 4 years from total experience, whichever gives you EARLIER ‘AFTER START DATE‘

- If 2 years from last 10 years are deducted (Go back 10 years from 3 April 2018, you get 3 April 2008), then add 2 years as a deduction to reach at 3 April 2010 – Called as Skill Applicability date.

- If 4 years from total experience are deducted, this date would come out as JUNE 2010. How? Count the relevant years from ACS report starting June 2006, you reach June 2010.

The second option results in an earlier ‘AFTER DATE’ for your work experience, and hence ACS will award you April 2010 date.