If you and your family are healthy and have no need to see the doctor every month, we strongly recommend getting a Health Savings Account.

Generally, people below 50 should be able to maximize their tax benefits by using an HSA account to accumulate money.

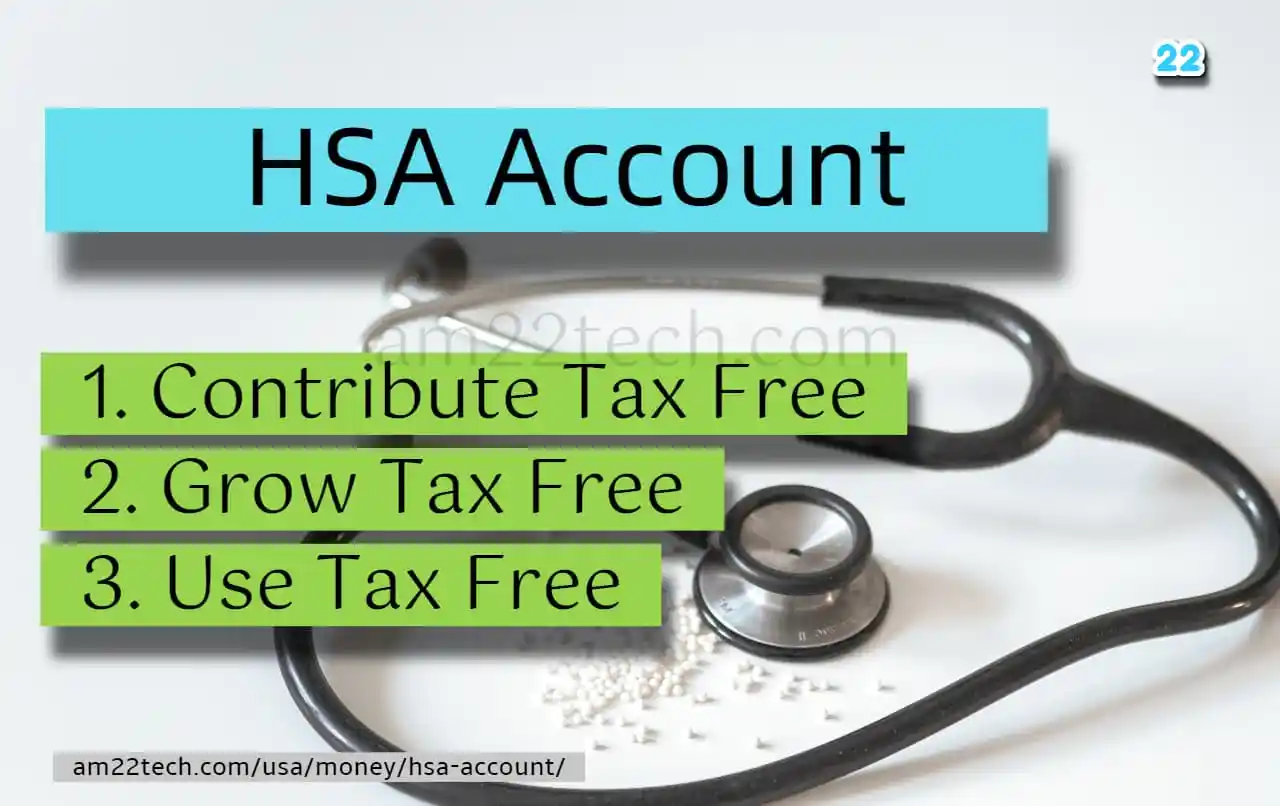

IRS allows you to let the money grow tax-free in an HSA account in 3 ways:

- The money added to HSA is tax-free – No social, medicare, or income tax is deducted

- The growth in HSA money via mutual funds or interests is tax-free

- The money used for medical purposes is tax-free

This is the best account as far as saving taxes and growing money tax-free is concerned after the usual 401k account in the USA.

For people from India working on H1B visas in the USA, the 401k account is similar to the Provident fund account.

2023 HSA Limits

Since the account offers tax-free money, there are strict limits on how much you can contribute each year. There is no limit on the amount of growth it can make once contributed.

| Tax Year | Single | Family |

| 2023 | $3,850 | $7,750 |

| 2022 | $3,650 | $7,300 |

If you are age 55 or older, you can add an additional $1,000 to these amounts. IRS allows you to add more amount for medical savings than people younger than 55.

We suggest keeping depositing money in HSA with each payroll. The easiest way is to divide the total yearly amount by 26 payrolls and then allow your employer to deduct it automatically.

How Much Should I Contribute to HSA?

We recommend maxing out the contribution as it helps you save taxes and pay for medical expenses tax-free. This is completely tax-free money given the fact that sooner or later in your life, you might need some kind of medical treatment.

Pradeep Mittal, who came from India to the USA and has worked for the same employer for 24+ years recommends using the maximum limits on HSA. He believes that HSA money is tax-free and you should use the maximum amount allowed by the IRS.

If you and your spouse both have their own HSA account, the maximum contribution limits still apply.

Example:

If Ram and Sita have their own HSA account, then both should agree on the portion that each will contribute to making sure the maximum family limit is not crossed.

- Equal amount: Both Ram and Sita can divide the maximum amount by half and then contribute to their own HSA.

- Full amount by one person: Either Ram or Sita can contribute the full total maximum HSA and the other can add zero to avoid breaching the limits.

- Other non-equal Divisions: Decide any amount that Ram will pay and then the balance will be paid by Sita or vice versa.

Note that if you contribute more than the maximum limit in any year to HSA, the extra amount that you add is taxed at 6% per year, every year from that day onward. This is called the HSA excise tax.

Invest & Grow HSA Money Tax-Free

Most HSA banks will allow you to invest the extra funds over a minimum to be invested in the stock market via the mutual fund’s route.

Example:

Optum Bank HSA allows you to invest any money over and above $2000 in your HSA account.

We recommend setting it on auto transfer to S&P 500 Index funds like the ones from Fidelity or Vanguard to let the money grow until you need it.

HSA banks also charge a service fee for account maintenance if the balance is below $3000. Check your bank’s contract with your employer to see how you can waive this fee.

Normally, if you keep a minimum of 3k in your HSA account, they should waive all fees.

Is HSA money Lost if not Used?

The money is yours and can be used anytime for paying for medical-related purchases. There is a long list of items that are eligible and includes over-the-counter medications like pain killer Tylenol, allergy relief like Flonase or Allegra, menstrual supplies, and other first-aid medicines.

If you are not able to use it, your spouse can use it after you have left this world.

Death of HSA Holder

We strongly recommend making your spouse the beneficiary of your HSA account. The IRS rules rely on spouse status to tax money once you die.

- The spouse is the beneficiary – Your money stays tax-free and it will be treated as your spouse’s HSA after your death.

- The Spouse is not the beneficiary – If you have someone else as the beneficiary like your child, then

- The account stops being an HSA, and

- The fair market value of the HSA becomes taxable to the beneficiary in the year in which you die.

- If your estate is the beneficiary, the value is included on your final income tax return.

Can I use HSA money for Non-Medical expenses?

You can withdraw money from HSA for non-medical expenses but you will need to pay the income tax, state tax, and then a 10% penalty before you can use it.

We strongly recommend not using it unless it is absolutely necessary. There are other better and less harmful ways of financing your emergency like:

Professional Visa Filing Service

Your trusted partner for a smooth application process.

Expert Support & Preparation

Get hassle-free visa extension and EAD filing professional support. Includes preparation, printing, photo editing, mailing and RFE preparation.

Fast & Efficient Service

Applications filed within 1-2 days with all documents ready. Emergency filing is also available to meet urgent deadlines.

Passport Photo Assistance

We professionally edit your photos to meet all US visa requirements, including background removal and proper alignment. Photo printing is included.

- Emergency funds from your savings account

- Get a Home equity loan which may cost only 3-4% APR

- Personal loans may just cost 6.99 APR which is still less than a 10% penalty in HSA

High Deductible Medical Insurance Plan

The HSA account can be opened only if you have subscribed to the High Deductible medical insurance plan. This simply means that you will pay a low premium but will need to pay more whenever you need any medical help.

AI Passport & Visa Photos in Minutes!

No studio, no waiting. Get perfectly compliant photos from your phone.

✨ Get My Photo Now See how our AI transforms your phone photo into an embassy-ready passport picture!

See how our AI transforms your phone photo into an embassy-ready passport picture!This is generally useful and in fact, a much better option if you do not have any regular medical needs.

You should opt for HSA (and a High deductible plan) if you:

- You do not have any disease and only visit a doctor for physical check-ups once a year

- Your child and spouse are healthy and only need medications here and there a couple of times a year for minor injuries or ailments like cough, cold, etc.

- You only need vaccinations like Flu every year, your child needs child vaccinations – these are always free in any insurance plan.

You should NOT opt for HSA if you:

On the other hand, people who have a regular need to see a doctor should not opt for HSA (and a high deductible plan). This is to make sure that the insurance company pays more than you do from your own pocket.

- You have Diabetes which needs regular medication and visits to the doctor’s office

- Your child has some ailment that needs monthly checkups

Can Visa Holders Open HSA Accounts?

Visa holders like F1, H1B, L1, and others can open Health savings accounts in the USA.

Since the HSA money can be used outside the US, you can use it in your home countries like China or India if you prefer treatment there for you and your family.

COBRA Insurance Premium by HSA

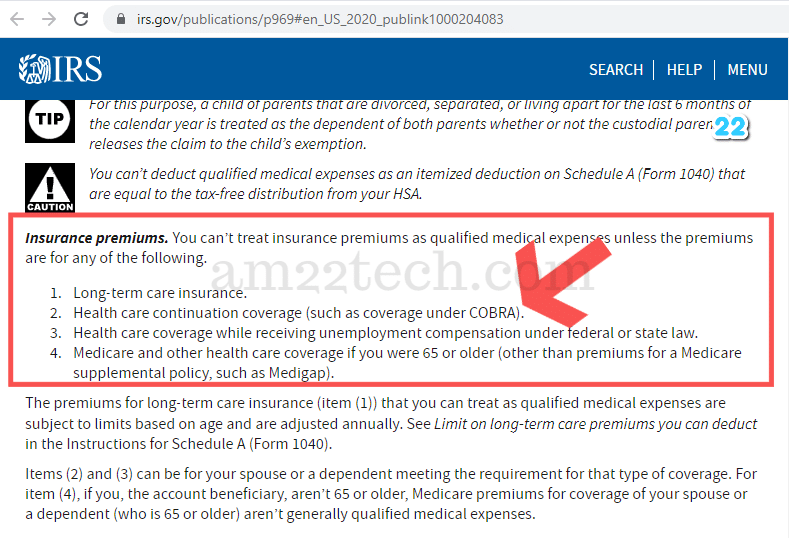

As per IRS rules, you can use HSA money to pay for COBRA coverage.

Most people including visa holders use COBRA whenever they join a new employer and want to keep their medical coverage from the old employer intact until the new employer’s coverage starts.

FAQ

You can add money to your HSA account during the year. There are two ways this can be done.

The first is to change your contribution to HSA through your employer as they deduct a fixed amount from your paycheck. This is the simplest and fastest way as the money added via paycheck is deducted before any tax is calculated on your salary amount.

If the employer does not allow changing the HSA contribution amount except at open enrollment time, you can do it the second way.

The second way is to do a direct ACH deposit from your checking or savings account to your HSA account. Do not worry about tax here as the amount you contribute here from your after-tax dollars can be claimed on your IRS 1040 tax return later to make it tax-deductible.

Tax-deductible simply means that the amount will be removed from your total taxable income before calculating the actual tax to be paid.

Yes, the HSA account has maximum limits decided by IRS each year.

For the tax year 2021, the limit is $7,200 for individuals +1 or family.

Normally, when you include a non-HSA-eligible item on the bill and try to pay with an HSA debit card, the bank will deny the transaction right there.

If the transaction is successful by any chance, the onus of keeping the account correct is on you. Note that IRS can demand the bills for the medical purchases for audit.

If the audit is done, you will be liable to pay taxes plus a 10% penalty on the amount used for non-HSA-eligible purchases.

Many people first buy medical stuff from a store like Walmart or a local grocery store and then return it. They do it to get cash as a refund instead of sending the money back to the HSA card.

Most stores will allow you to get cash as a refund if you had used the debit card to purchase it in the first place.

Although it is difficult to track this kind of transaction and you may get away with it, but it is not in good faith. Note that the store is not responsible here but you are.

If audited by IRA, you may have to pay tax and a 10% penalty.

You can use your HSA amount outside the USA for medical treatment. Many people visit neighboring countries like Mexico and others visit Turkey or India for cheaper surgeries.

The travel expenses can be paid through HSA if the sole purpose of the trip is medical treatment.

If your trip to another city or country is primarily a vacation and then you want to get the medical treatment on the side, the travel expenses cannot be included in HSA. It is definitely a good idea to visit other countries to get the same treatment at half the cost.

For example, if you travel to Mexico only for a Dental root canal procedure, you can claim the doctor’s treatment expenses through HSA along with air or travel tickets.

The onus of proving that the trip was only for treatment will be on you if IRS sends an audit.

Yes, Sunscreen can be bought using HSA money.

Cosmetic surgeries like Hair transplants, weight loss, skin treatment, plastic surgery, and other such surgeries cannot be paid for through an HSA account.

The only exception is when your doctor prescribes these as part of treatment for some other disease.

Example:

If the doctor is treating heart disease and prescribes weight loss as a mandatory treatment, then you can include weight loss expenses in HSA as an exception.

If the doctor performs plastic surgery to reconstruct the breast after the removal of the original breast while treating cancer, the surgery will be HSA eligible.