|

Listen to this article

|

A lot of people who work in the USA on non-immigrant visas like H1B have been moving to Canada to get a reliable future in terms of permanent residency.

The move to Canada from the US is easy except for the transfer of a Robinhood account.

Robinhood is not available in Canada as of writing this article. We will update it as and when this changes.

Also, if you move to Canada permanently, meaning that you are not maintaining a physical presence in the US, then you are also not eligible to maintain your Robinhood account.

This is mandated by IRS rules and not Robinhood.

This article will discuss:

What happens if you Move to Canada?

Robinhood will detect your location as and when you log in to your account. Once they detect that you are outside the US, you will need to re-verify your US address with a government-issued photo ID card with a US address.

If you still have a valid ID, you may be able to extend your Robinhood use until the ID expires.

Many people who move to Canada on PR use the VPN to hide their real location. This may be helpful for a short period since Robinhood forces you to sell all your investments once they detect that you are not a US resident anymore.

Restrictions on US Accounts

Creative Planning recently reported that most banks and almost all stock brokers have added these restrictions for non-US residents due to stricter FATCA and European Union rules.

I found this Reddit thread where a Fidelity representative has cleared the confusion. The important points:

- You can maintain your existing US accounts, but cannot create new accounts.

- You should be able to create a new account with the same company’s entity in the destination country though.

- Example: If you move to Canada and Fidelity offers stock brokerage as ‘Fidelity Canada’, you should be able to open a new account with them and start trading afresh.

- Trades (buy and sell) of most individual US stocks and exchange-traded funds (ETFs) are allowed.

- Purchases of new US mutual funds or adding to MFs will NOT be allowed. Automatic dividend reinvestment will be allowed.

Merill Lynch, Morgan Stanley, and Charles Shwab also have similar restricted rules as Robinhood for non-US residents.

The grace time may vary by each broker company.

Example:

Fidelity stops the purchase of new stocks, mutual funds, and ETFs after 60 calendar days of relocation.

You can re-activate the option to buy/sell by submitting the IRS W-8 form. Mutual funds investments are not allowed even after filing a W-8 form.

Most of them use the app installed on your smartphone to track your device’s IP address to find your physical location.

You can of course sell your shares anytime but new deposits are not allowed.

Do not worry about the control of your account. Even though your account will be restricted, you maintain control over when investments will be sold.

401k Account

You will be able to hold your investments in a 401k account and not be required to sell them immediately.

As per IRS requirements, your brokerage firm (like Robinhood, Fidelity, Morgan Stanley, etc) will need you to fill out IRS form IRS W-9 or W8-BEN for correct tax withholding on withdrawals.

You should ideally wait till you reach retirement age to sell and withdraw 401K money to avoid early withdrawal penalties.

Credit Cards

If you have a branded credit card through Fidelity, Charles Schwab, or Robinhood Gold card, you can keep using it normally.

There is no restriction on using those cards outside the US as they are issued through a separate bank entity.

Treat them just like any other credit card you have.

Need Help File Application?

Support

Use hassle-free visa extension and EAD filing service to file your application with USCIS

Visa status issues consultation includedQuick Service

Filed within 1-2 days if you have all the documents ready and uploaded

Emergency service availablePhoto

You click, we edit photos as per US visa requirements to remove background, align face and shoulders

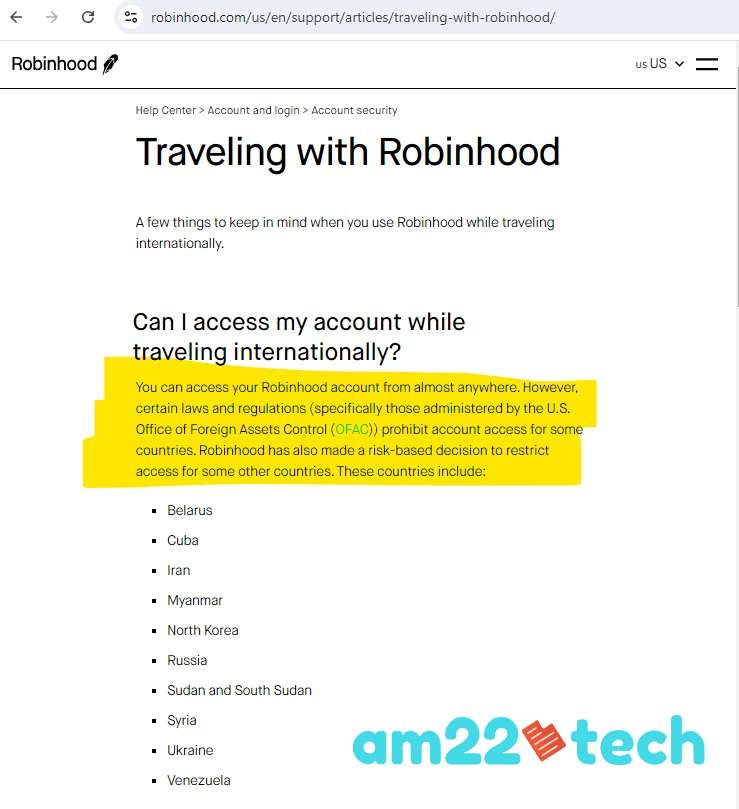

Photo printing includedRobinhood Restricted Access

Robinhood restricts access from certain countries that do not have good relations with the USA.

These restrictions are meant only for people who are temporarily traveling to these countries. It only means that you being a US resident, cannot access your Robinhood account while you are physically in these countries unless you bypass it through a VPN connection.

Social security account is managed separately by the SSA.GOV government entity.

The rules for social security are different than the rules for stocks and securities.

Your Social Security account can be maintained from outside the US and you will stay eligible for receiving the Social Security amount from outside the USA.

FAQ

As per current information available after speaking to multiple people who have moved to Canada, I conclude that Robinhood asked them to sell and take the money unless they can prove with government ID that they are US residents.

The policies keep changing and they may provide a better option if they start operations in Canada in the future.

Other companies like Fidelity offer to maintain the account but you can’t buy or sell. They don’t force you to sell your existing stocks, or 401K either.

Robinhood usually offers 2 options:

1. Sell everything and transfer proceeds to a USA bank account.

2. Move assets to a different brokerage like Fidelity, Charles Shwab, etc.

As of writing this article, I could not find an option to do an international wire transfer option on the Robinhood website. They may or may not offer it in the future.

Most other large brokerage companies (like Ally, Spencer Clarke, Fidelity, Charles, Chase, etc.) offer to do wire transfers or send a physical check to you outside the US. You can then deposit the money in your local Indian or Canadian account, as an example.