|

Listen to this article

|

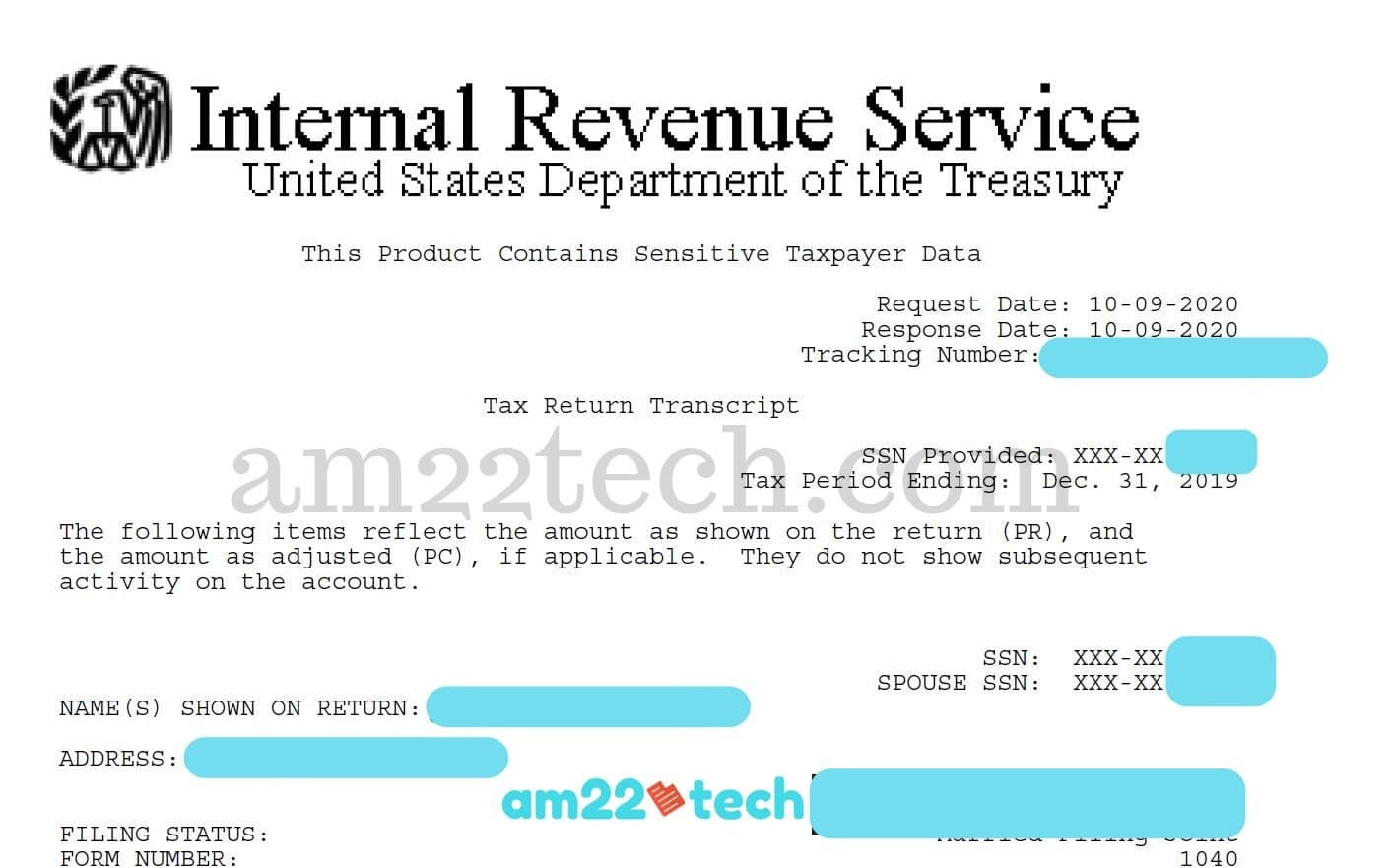

IRS tax transcripts are required for i-485 filing. It should be your first preference to send transcripts instead of W2, 1040, or pay stubs.

Tax transcripts are available online as well as by postal mail. Online is fast and easy once you have created an online account on the IRS website.

IRS website has strict security and verifies your identity with various methods before letting you create an account.

This article will discuss:

Documents for IRS Transcript

#1 Email Address

The first step is to verify the email. IRS sends you a code that you need to enter.

#2 Most recent Tax return details

Your First Name, Last Name, Date of birth, full address, and SSN are required and they should match your most recent tax 1040 return.

IRS will ask you to enter this information after email verification.

#3 Credit Card / Home Mortgage Loan / Auto / Personal Loan number

Anyone with a visa, Mastercard, or Discover credit can be used.

IRS makes a soft inquiry on your credit file to verify your identity. The inquiry will show up on your credit but will not reduce your credit score. You can check the effects on your credit report using a free credit report.

Debit cards or bank account information cannot be used here.

If you do not have any of the credit products, then your only option would be to use postal mail for transcripts.

Transcripts by post can take 7-10 days. If you cannot wait as your visa bulletin date might be running out, you can send the W2 and 1040 and then later submit the tax transcripts if you get an RFE.

#4 Valid US phone number on your own name

The last step is to verify your phone number.

Google Voice or a similar virtual number is not acceptable.

Once the phone is verified, the IRS will let you create an online account.

#5 Download Tax Transcript

Once your account has been created, you can immediately download all the tax transcripts easily.

Check My Substantial Presence

Types of Transcript

IRS offers 4 types of typescript which may serve a different purposes. For filing an i-485 adjustment of status, we suggest downloading all 4 types and sending it with your application package.

#1 Return Transcript

Tax Return Transcripts show most line items from your tax return (Form 1040, 1040A, or 1040EZ) as it was originally filed, including any accompanying forms and schedules.

This transcript does not reflect any changes you, your representative, or the IRS made after you filed your return.

Need Help File Application?

Support

Use hassle-free visa extension and EAD filing service to file your application with USCIS

Visa status issues consultation includedQuick Service

Filed within 1-2 days if you have all the documents ready and uploaded

Emergency service availablePhoto

You click, we edit photos as per US visa requirements to remove background, align face and shoulders

Photo printing includedA ‘Return Transcript’ is good enough in most cases like bank loans including mortgages and student loans and immigration.

#2 Record of Account Transcript

Record of Account Transcripts combines the information from tax accounts and tax return transcripts.

#3 Account Transcript

Tax Account Transcripts provide any adjustments either you or we made after you filed your return.

This transcript shows basic data, including marital status, type of return filed, adjusted gross income, and taxable income.

#4 Wage & Income Transcript

Wage and Income Transcripts show data from information returns, such as W-2s, 1099s, and 1098s reported to the IRS.

The most recent year information may not be complete until July.

Names and Address Cut off On Transcript

Do not worry about the names and addresses cut off on the transcript. It is normal and is done intentionally to protect your personally identifiable information.

FAQ

You can leave the customer file number empty for the purpose of getting a transcript for immigration purposes.

This number is usually shared by a mortgage lender or other such financial institution that wants to verify your transcripts. They would share this number with you to match the transcripts later.

The transcript files are shown to you in XHTML format. The download might fail.

You should try the ‘print’ option and then save it as ‘PDF’ on your laptop, computer, or mobile phone.

You should select the purpose of the transcript as ‘immigration’.

IRS tax transcripts should be your first preference. They are available free of cost and can be easily downloaded from the IRS website.

If you cannot get tax transcripts or run out of time to file your i485 application due to limited time left in current visa bulletin dates, you can submit your last year’s W2, tax return 1040, and pay stubs.

The ‘return transcript’ is good for filing the USA green card i-485 adjustment of status application.

If you have filed your taxes as married-filing-jointly, then you can use the same tax transcript copy for the whole family.

If you filed taxes individually, then each person in the family should get their own tax transcript from the IRS website.

The kids are usually included on the separately filed tax return on either the father or mother’s tax return.